rational fund

thinking in decades, not months.

investment letter

▪️ Press: we invested in Odin alongside Jim O'Shaughnessy (OSV) after our intro▪️ Press: we invested c. half a million dollars alongside Founders Fund

Authenticity

Truth-seeking

Long-termism

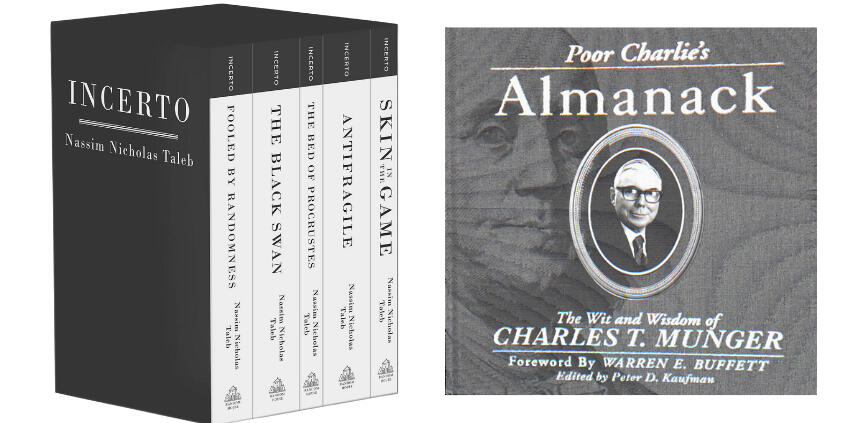

You may have heard of us from rationalvc.com — our top-charting podcast & essays.Inspired by Warren Buffett's original partnership model (fund structure), Nassim Taleb's barbell strategy (portfolio construction), and our ever-growing deal flow, we have a partnership where:

we invest $250,000 to $1 million in pre-seed to series-A rounds, and

we invest in public markets.

We take outside capital only for private market (venture) investments. Our non-negotiables:

We are against the concept of charging management fees (charlatanism).

We believe that as GPs (syndicate leads) we must also have skin in the game in each deal.

Founding team must fit our 3 core no-BS values, AND it's a company we'd work at ourselves.

We reject unsuitable LPs (also must fit our values), AND seek to preserve autonomy & fun.

We are operators by day and VCs part-time. This is in your interest. Why? Read here & here.

We don't spray & pray, rather: "A few great companies is all you need in your lifetime."

“Patience followed by pretty aggressive conduct when the time comes.”

— Charlie Munger

Many funds live off management fees, operating as glorified middlemen with no skin in the game and no operating experience—barely returning the fund, and when they do, the returns are subpar (you’d be better off in an index fund). Incentives are misaligned. They're also typically forced to deploy capital within 18–24 months before raising the next fund. We’re not forced to invest in subpar companies, thanks to our structure. We may do 10 deals a year—or none at all. We're built for long-termism.

History:We began micro-angel investing in 2022 after having selectively interviewed the founders of:Acquire.com, Varda Space Industries, Eight Sleep, Sturgeon Capital, and many other companies.We began to receive ever-increasing deal flow and decided to syndicate our access going forward.Two LP buckets: founders/operators (small tickets), and family offices/funds (large tickets).Contact us to enquire about becoming an LP and joining us on our multi-decade game.

Current portfolio (+ OGs on cap table)

Services & expertise

Content & copy

Intros to network

Financing strategy

Sales & GTM

Hiring

Decks & reporting

Commercial DD

Technical DD

*MSCI is ~85% barbell; the remaining ~15% consists of skin-in-the-game investments in our own syndicates (listed above), or other high-risk bets we back.

Video for LPs on why we structure our venture investments as syndicates:

📝 Our OG viral essay for LPs on syndicates vs. funds